How transactions and documents are matched

The auto-match is rechecked on every invoice update for the first 14 days after invoice's creation. After that period has passed, the match will stay as is regardless of what happens.

Manual matches don't count. Once a user manually matched a transaction there are no further matching checks of any sorts performed.

Transactions which are already matched to a document, will not be considered for future matching runs. There is no breaking-up and re-match if document arrivals would bring better matching candidates.

Invoice update, in this context, is exclusively updates received from our invoice data providers (Services for invoice feature extraction.). Doing an update on the invoice in the UI does not trigger the check.

The matching algorithm is exclusively run only when:

domonda imports transactions

domonda imports invoices

external data provider updates the invoice

What does “invoice number / order ID(min length of 4 chars) appears in transaction“ mean? The complete Invoice Number has to be present in the transaction, and the Invoice Number must be 4 or more characters long

Date Difference between Invoice Date and Bank Transaction Date

The Invoice date must be at the transaction value/booking date or up to 28 days (4 weeks) in the future.

The Invoice date must not be more than 120 days (4 months) before the transaction value/booking date.

If these requirements do not apply, the Invoice will not be taken into account for matching.

Default Matching Pipeline

These are the domonda defaults, sorted by priority top to bottom. If a clause matches, the rest is ignored.

pain.001

NOTE: pain.001 does not have any sub-checks its just a placeholder because the check is ran in a seperate custom query

Default 1

transaction type is bank

ibans match

totals match with allowed +-10% deviation (with max total diff of 300)

invoice number / order ID (min length of 3 chars) appears in transaction purpose

Invoice number and 120 days date diff check

invoice number / order ID(min length of 4 chars) appears in transaction

dates are not more then 120 days apart (invoice date must be in the past)

totals match with allowed +-10% deviation (with max total diff of 999,999 (no max total diff))

Default 2

transaction type is bank

ibans match

totals match with allowed +-3% deviation (with max total diff of 100)

dates are not more then 18 days apart (invoice date must be in the past)

Default 3

transaction type is bank

totals match exactly

dates are not more then 60 days apart (invoice date must be in the past)

transaction partner is at least 3 characters long and is at least 65% similar to the invoice partner

Default 4

totals match exactly

invoice number / order ID(min length of 3 chars) appears in transaction purpose

Default 5

totals match with allowed 2% negative deviation and 10% positive deviation (with max total diff of 300)

invoice number / order ID(min length of 4 chars) appears in transaction purpose

Default 6

totals match with allowed 2% negative deviation and 5% positive deviation (with max total diff of 300)

last 5 characters of invoice number / order ID appears in the transaction purpose

dates are not more than 28 days apart (invoice date can be up to 14 days in the future)

Default 7

transaction type is credit-card

totals match with allowed 10% positive deviation (0% negative)

invoice date in format "DD.MM." appears in the transaction purpose

Default 8

totals match exactly

transaction partner is at least 3 characters long and is at least 65% similar to the invoice partner

dates are not more than 28 days apart (invoice date can be up to 14 days in the future)

Default 9

totals match with allowed 2% negative deviation and 10% positive deviation (with max total diff of 100)

transaction partner is at least 3 characters long and is at least 65% similar to the invoice partner

dates are not more than 6 days apart (invoice date must be before the transaction date)

Default 10

transaction type is credit-card

totals match with allowed 5% deviation (Invoice sum is higher than transaction amount)

transaction partner is at least 3 characters long and is at least 65% similar to the invoice partner

dates are not more than 3 days apart (invoice date can also be before the transaction date)

Adaptations to the Default Matching Pipeline

For several reasons, customer specific matching rules may lead to better results. If you assume a specific matching tuning can increase the performance of your matching pipeline, get in contact. This is a commercial update to domonda default and is possible in several ways.

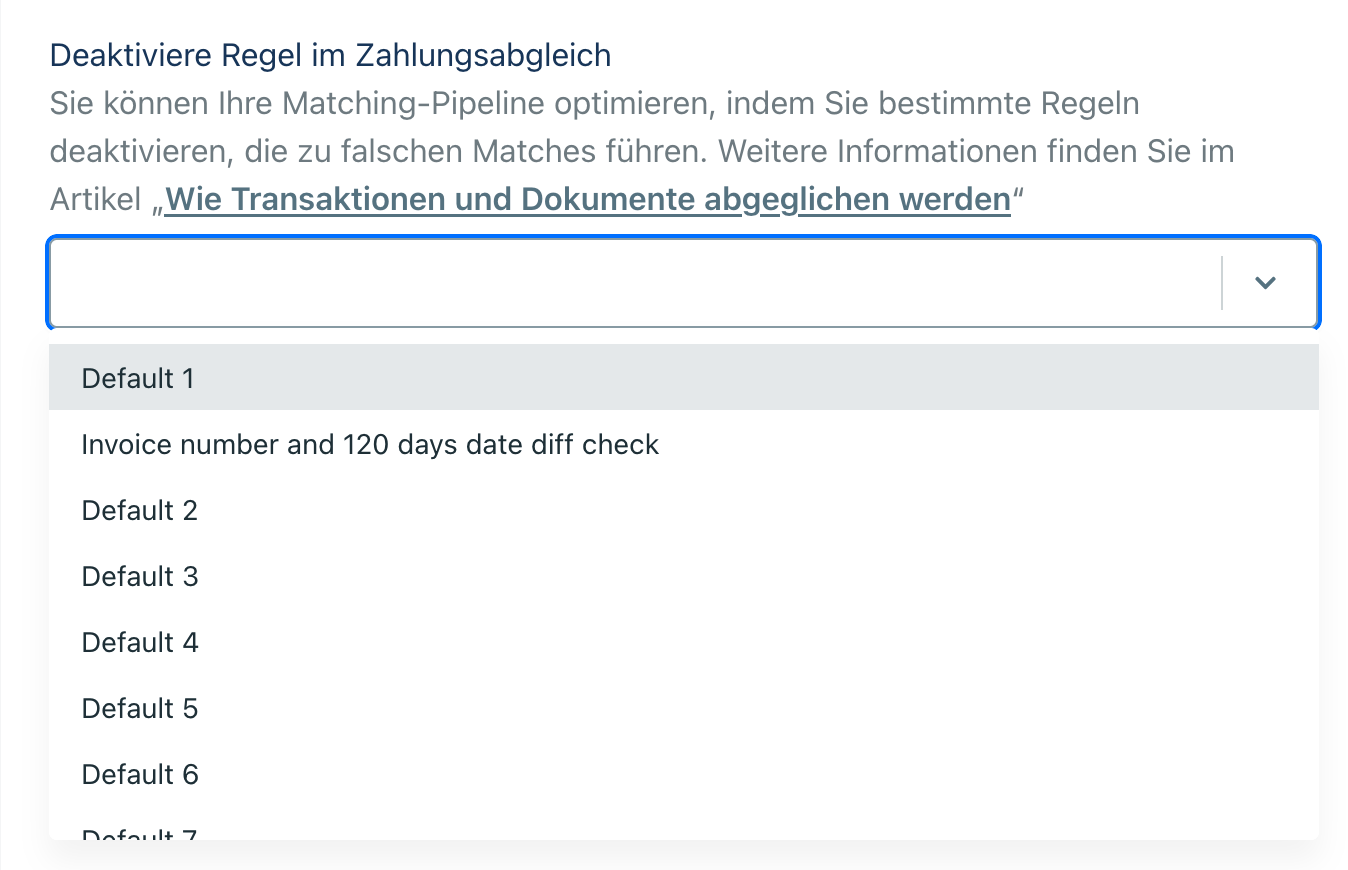

Besides these projects we offer adaptions to the Matching Pipeline by disabling certain Criteria in the Advanced Settings of your Accounts (Settings > Company > Advanced).

You can disable certain Criteria and experiment with “Matching Pipeline” - Tuning: